If you are looking for a Stable Term Life Insurance Option, you could do not better than the Principal Life Insurance Company.

The Principal Financial Group Inc owns numerous divisions including two life insurance groups: Principal Life Insurance Company and Principal National Life Insurance Company. Both are AM Best rated A+ and these Iowa based carriers deserve a consideration because of their product selection and their employer multiple awards.

Principal Life:

The Principal Financial Group and their life insurance carriers: Principal National Life Insurance Company. and Principal Life Insurance Company are well known in the US Insurance Industry. This Iowa, A+ rated insurer offers a terrific set of Universal and Term Life insurance for individuals. The company also offers a broad set of other financial services. The purposes of this article though in on their Individual life Insurance.

This Iowa based A+ Rated Life Insurance Company has had stellar financial performance mixed with solid customer service and happy employees.

Principal Contact Information:

Insurer Full Name: Principal Life Insurance Company and Principal National Life Insurance Company are both fully owned by Principal Financial Group Inc.

Insurer Physical Address: 711 High Street Des Moines, IA 50392.

Insurer Phone Number: 515-247-5111

Insurance Fax Number: 5115-247-5491

Insurer Website: principal dot com

NAIC Number: Principal Life Insurance Company: 61271

NAIC Number: Principal National Life Insurance Company: 71161

Officers of this Insurer: Daniel J. Houston - CEO

Amy Friedrich, President - U.S. Insurance Solution

Gregory Linde, Senior Vice President – Individual Life

Dennis Menken, Senior Vice President and Chief Investment Officer–Principal Life Insurance Company

Insurer Ticker Symbol: PFG

Insurer Other Names: There are dozens of operating entities with the Principal Financial Group Incorporated of which Principal Life Insurance Company and Principal National Life Insurance Company are the two main considerations for life insurance purposes.

About the Principal:

The Principal Financial Group Inc. has four main business markets: Income and Retirement, Principal Global Investors, US Insurance Solutions, and Principal International. The company employs nearly 15,000 people worldwide and is one of the largest Iowa employers.

The company has received numerous awards including being named one of the most Ethical Companies in March of 2015 and as one of America's Best Employers also in March of 2015 by none other than Forbes Magazine.

The History of the Principal:

Founded in 1877 as the Bankers Life Association in Iowa, this company has a legacy that stretches back more than 100 years. The company changed its name to its current form (more or less) in 1985. In 2001 the company went public with stock market listing. A minority of the company is owned by Nippon Life Insurance company, of Japan.

Insurer Sweet Spots:

First and Foremost the Principal's A+ rating should be considered. Many life insurers are not as well placed financially. There are only about 125 or so carriers rated A+ and A++ in the United States.

The principal has specific underwriting niches that may make them a better carrier for you.

One of these special underwriting considerations is Sleep Apnea. Sleep apnea is a condition whereby patients experience moments when their breathing is interrupted. This occurs, obviously during sleep. This condition is far more dangerous than many people know. The Principal is one of the very few carriers that can end up being slightly more lenient in certain situations. Those situations are most commonly for those that have well treated sleep apnea and are under the care of a physician. If this is you, than the Principal may be the best carrier for you.

For some patients that have diabetes - the Principal, in comparison to other life insurers may be a good option. This of course depends on your exact medical situation.

The Principal may also have a good solution for seniors whose weight is just a bit higher. Each life insurer has their own build charts and theirs for seniors may be more generous.

The Principal Sample Pricing:

Below are some sample pricing for term life insurance contracts from Principal life insurance. These prices may or may not apply to you. Speak with a licensed agent to go more accurate pricing for your situation.

Banner Life INsurance Sample Life Insurance Rates $400,000 Non Smoker

Various Ages, CA, 20 Year Term - Non Smoker

$400K 20 Year | Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

Male Age 32 | $223 | $283 | $351 | $419 |

Male Age 37 | $261 | $321 | $421 | $518 |

Female Age 32 | $198 | $247 | $314 | $376 |

Female Age 37 | $234 | $293 | $373 | $444 |

*all sample pricing - subject to change.

Great Candidates of this Insurer:

Who should consider term insurance from Principal Life Insurance, here are three examples:

"Do I Really Need a Principal Life Insurance Policy?"

A working single parent living in Kansas who is a Carpenter. He chooses a $100,000 twenty year policy to protect his stay at home wife and three children.

The working widowed mother who has well treated sleep apnea. She opts for a $250,000 ten year term policy to help care for the children in case of her untimely death. She is relieved to have her policy in place.

The Mom and Dad who are both lawyers and live in New York City. They each purchase $1,000,000 twenty year policies from the Principal. In addition they each have small group policies through their employers.

Insurer Products:

The Principal offers two main types of individual life insurance policies: Term and Whole life insurance. Whole life insurance is form of permanent insurance that once started would last for the entirety of your life, assuming you continue to pay the bill. Whole life insurance has the potential to grow a cash value account, which is a pseudo savings account. Term is the exact opposite, it is pure insurance. Term is sold in bands of time, often ten, twenty, or thirty years. After that period of time the insurance coverage is usually finished.

Universal Life Insurance

The principal offers four different types of Universal Life Insurance. All of them offer life insurance for your entire life. Typically this means both the actual coverage and the yearly premium.

Principal Universal Life Insurance: Potentially the simplest of the UL policy options, Universal life insurance allows for flexibility and potential growth in the cash account.

Principal Indexed Universal Life Insurance: Indexed UL policies allow a portion of the yearly premium to be set aside in accounts that grow with a stock market index. IUL policies typically have a ceiling and floor to the returns that once can receive.

Principal Variable Universal Life Insurance: This for of universal life insurance is even more complex than standard UL policies. Used more for wealth accumulation and less for pure insurance purposes.

Principal Survivorship Life Insurance: Survivorship life covers two different lives together. Often used in estate planning these policies pay out on the second to die.

Principal Term Insurance

This insurer offers a multitude of terrific and simple term life insurance products. The term lengths they offer include: ten years, fifteen years, twenty years, and thirty year term lengths. One of the great things about term insurance is the ability to choose the band of time that works for you and your family. Lots of options, Lots of Choices.

For the vast majority of Americans Term Life Insurance is the best place to start and usually end with. Often consumers opt to choose the length of term that gets them to the period of time when their children are out of the house and self sufficient. Universal life insurance today is far more controversial. Although Universal policies such as GULs, IULs, and VULs all have their place. Their place might not be for the average American. The far simpler solution is generally a term policy.

Insurer Riders:

All insurers offer various riders to life insurance contracts. These Riders or Endorsements are changes or modifications that consumers can elect during the initial setup of the policy.

Accelerated Death Benefit Rider: This common life insurance rider allows for an early partial death benefit payout in the event of a confirmed diagnosis of a terminal illness. The thought is that you may be able to use the money for some life saving treatment or to take that trip you always wanted to.

COLA - Cost of Living Increase: This less common rider allows for an increase in the insurance coverage based on an inflation metric.

Extended Coverage Rider: This rarely seen rider allows for for coverage to exist beyond the stated endpoint of the contract which is usually 121 these days.

Lapse Protection Rider: This rider potentially protects you from a lapse in your coverage.

Child Life Rider: Most insurers have this rider and Principal is no different. The child life rider allows you to add coverage for your children. There is almost always a cost to do this.

Salary Increase Rider: for Business Insurance cases, this rider allows you to potentially increase your overall insurance coverage due to an increase in salary. There is a cost for this rider

Waiver of Monthly Premium Rider: This common rider allows you to not pay your premium if you become disabled. There is a certainly a fee for this rider. Numerous specifics exist with the definition of confirmation of being considered disabled.

These riders are state specific. The Principal has a very robust set of rider options. Some are only available with select types and kinds of insurance contracts. More specifics, of course exist.

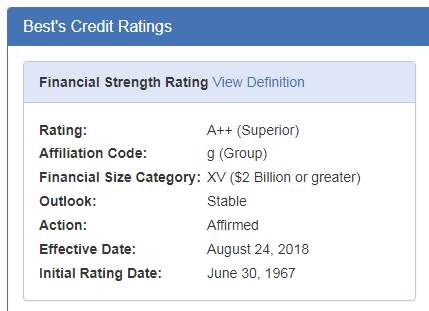

Financial Strength Rating of the Principal:

The Principal Financial Group Inc. owns two distinct consumer life insurers: Principal Life Insurance Company and Principal National Life Insurance Company. Both are rated AM Best A+. The company also owns numerous other insurance type entities such as Principal Capital and Principal Reinsurance Company of DE. However for the purposes of this article we focus on Principal Life Insurance Company and Principal National Life Insurance Company.

Principal Life Insurance Company:

Rated AM Best A+. This A+ rating was reaffirmed as of February 2018. Their financial category size is an XV which means $2 Billion Dollars or Greater.

Principal National Life Insurance Company:

This other entity is also an A+ rating was reaffirmed as of February 2018. Their financial category size is also an XV which means $2 Billion Dollars or Greater.

So What does an A+ Financial Strength Rating mean for a company like the Principal?

An A+ rating is one notch from the AM Best Top, which is A++. Although it is not the highest rated insurer, an A+ rating is still considered superior and virtually second to none. Whole Vs Term believes that an A+ rating is acceptable for almost all life insurance transactions. These include all term life insurance policies. For whole life and other permanent policies we believe that an A+ rating is pretty acceptable. However with these types of "forever" policies further research is warranted. We make no advisement on the suitability for annuities and other financial contracts.

Other Financial Strength Ratings from other Rating Bureaus are as follows:

Moodys: A1 for both Principal Life Insurance Company and Principal National Life Insurance Company.

S&P: A+ for both Principal Life Insurance Company and Principal National Life Insurance Company.

Fitch Ratings:AA- for both Principal Life Insurance Company and Principal National Life Insurance Company.

Questions About the Principal:

Question: Where is Principal Life Insurance based?

Answer: Principal life insurance and their parent Principal Financial Group are based in Des Moines Iowa.

Should you have questions about this insurer or life insurance kindly send them to us. You can add them to the comment box below or email us directly. scott at marindependent.com

Conclusion about this Insurer:

The Principal is a great insurer for individual life insurance policies. They have a lot of offer many consumers. Their AM Best A+ Financial Strength Rating, their fair pricing, and their employees make for a great combination.

Thank you for Reading our article

Enter your text here...

Speak with an experienced advisor!

Speak with an experienced advisor!