Farmers New World Life, is a Washington based Insurer with an 'A' Financial Strength Rating. One of their products offered is their Farmers Index Universal Life Insurance which is a type of Permanent, Universal Insurance. IUL products are a combination insurance and investment. These types of policies have been noted by the Wall Street Journal to have numerous pitfalls. In our review we discuss questions to consider before purchasing this product.

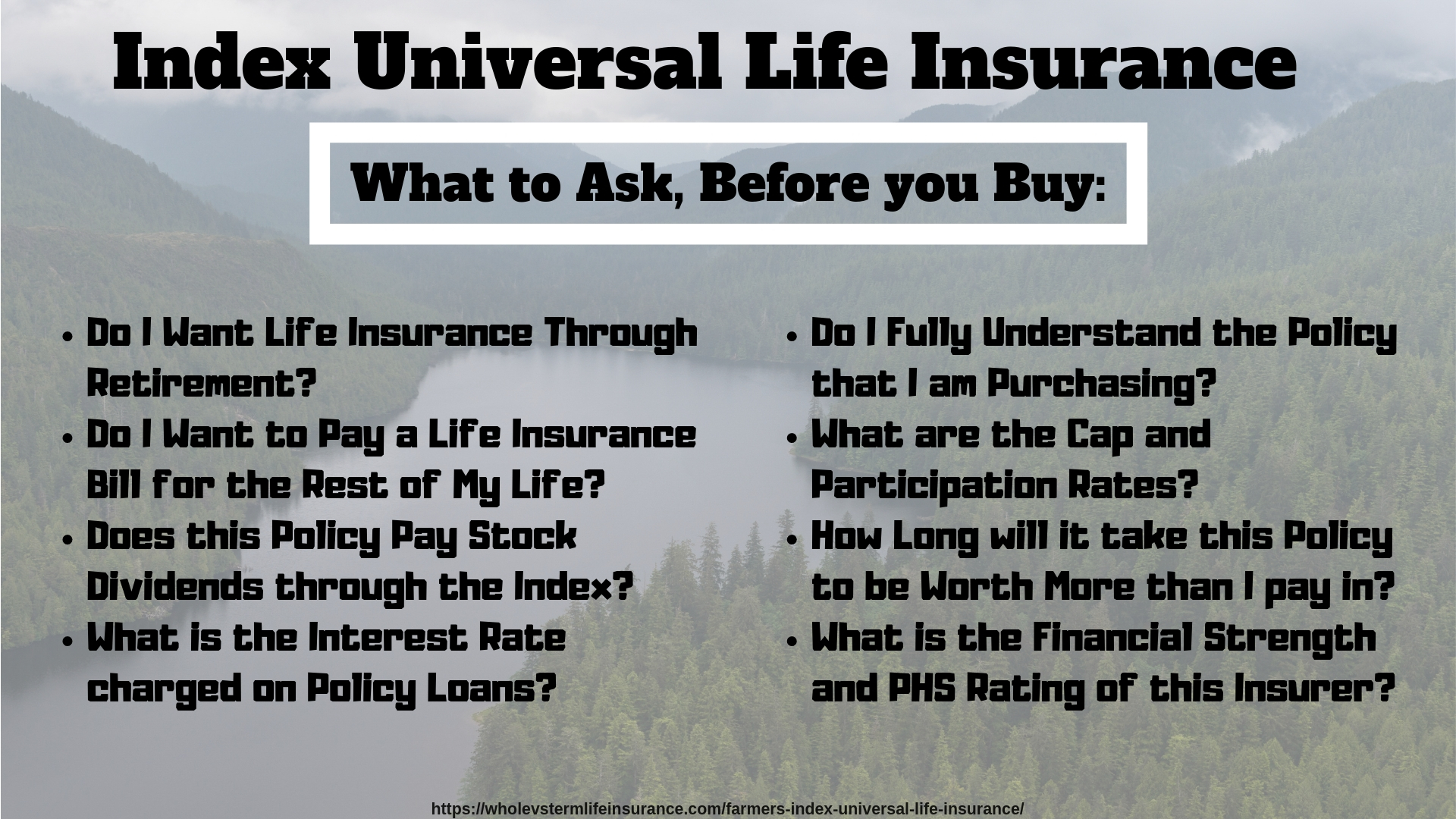

What to Ask before you Purchase a Farmers Index Universal Life Insurance Policy:

Universal life is a form of Permanent life insurance, it is meant to be kept forever. Ask yourself this: Do I want life insurance, for the rest of my life, even through Retirement?

Universal life insurance premiums will need to be paid, more than likely forever. Therefore its important to ask yourself and your spouse: Do I want to pay a Universal Life Insurance Premium, for the rest of my life?

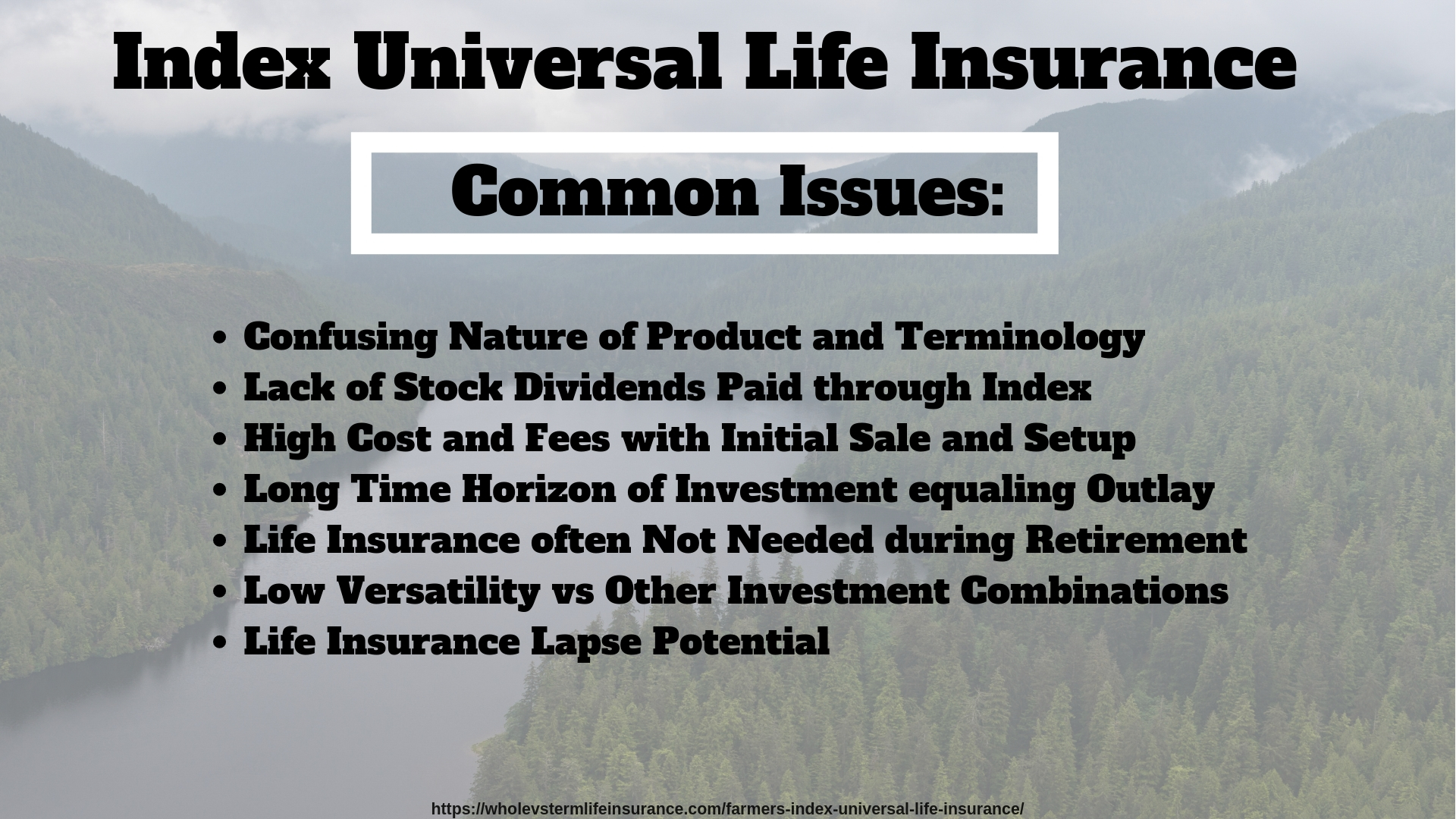

Universal life insurance is incredibly complicated. Do I fully understand the policy that I am purchasing?

Indexed Universal Life Insurance policies do not simply pay out how the Stock Index performs. Considering asking What is the Cap and Participation Rates of this policy and how do these numbers get utilized in regards to the index performance?

Investment returns from most indexed universal life policies, typically exclude earnings from Stock Dividends. Ask your Farmers Agent: Does the Farmers Universal Life Insurance policy pay dividends from S&P 500 and Russell 2000 stocks?

Whole, Universal, and Variable Life Insurance is almost always slow to build up Cash Value. Ask the Agent: How Long will it take for my policy to be worth more than I pay into it? In other words, when will this product show an investment return?

Many permanent policies market that you will have access to your cash, via policy loans. An intelligent question would be What is the Rate of Interest that I must pay in order to get access to this cash?

Many life insurance plans sold by home and auto insurers, offer a discount. What exactly is the life insurance discount that is applied to my home and auto policies? Is there a discount that gets applied to my life policy as well?

Another important question to always ask any Captive Insurance Agent and Insurer when you are considering a life insurance policy is: Which Life Insurance Health Class do you think I will qualify for? As we have discussed in numerous articles it is the Health Class that is most Important, not the base life insurance rate.

What is Farmers Index Universal Life Insurance:

Farmers markets their life insurance policy as: " the best of both worlds – the lifelong coverage you may need and the opportunity for lower-risk cash value growth you want." The product is offered from Farmers New World Life Company. The product is also noted as having: "Lifelong Insurance"..."Cash Value Accumulation"..."Choice"...and "Risk Protection."

Indexed Universal Life Insurance is a type of Universal, permanent life insurance. UL typically offers flexible yearly premiums with the potential for cash growth. Indexed Universal is often abbreviated as IUL.

The Farmers life policies gives you the option of having your "investment" within one of two options and/or two fixed accounts:

The two fixed accounts pay out (according to their website): "The Long Term Fixed Account has a minimum interest rate of 1% while the Short Term Holding Account has a minimum interest rate of 0.1%..." [This information is taken from January 2019 and is subject to change, and may not be noted on this site.]

This Farmers New World Life product was introduced in 2015, " In response to consumer demand for more life insurance options that offer lifetime coverage with potential cash value growth..." Press Release.

The policy has useful optional riders as well. These riders include: a "chronic illness rider in most states."

This is not the only type or kind of life insurance that Farmers offers. Our records show that Farmers also offers Term Life Insurance products, Whole life, and other types of Universal Life Insurances.

Farmers New World Life has an AM Best Financial Strength Rating of A. This is the third highest rating after A+ and A++. Their policyholder surplus rating is "X" which is from $500 Million to $750 Million.

Three of Farmers Companies "Farmers Insurance Exchange, Fire Insurance Exchange and Truck Insurance Exchange" form the The Farmers Exchanges. This is a Reciprocal Exchange.

The company is based in Mercer Island, Washington. Their NAIC number is: 63177.

Important Farmers Index Universal Life Disclosures:

Attached in their marketing material is an important disclosure, AKA the fine print. This fine print is essential reading:

Point 2, referring to "you may even access the cash value while the policy is in force" - "Policy loans and withdrawals will reduce cash surrender value and death benefit. Policy loans are subject to interest charges. If your policy is a modified endowment contract, loans and withdrawals may be subject to taxes and penalties." This may or may not refer in part to direct recognition.

Point 5 referring to: "The indexed accounts pay an annual or monthly credit" - "Indexed account credits are calculated at the end of each one-year segment for each indexed account.The growth rate is calculated based on the value of the index at the end of the segment compared to the value of the index at the beginning of the segment. The growth rate is then multiplied by a participation rate and capped at the cap rate declared by the company, and cannot be less than the minimum guaranteed rate of 0%."

Point 6 referring to "general tax-free life insurance protection" - "For informational purposes only. In general, partial withdrawals from a permanent life insurance policy in excess of the policy’s basis are taxable, and limited circumstances exist where death proceeds will be taxable. Neither Farmers New World Life Insurance Company, its employees nor its Agents provide legal or tax advice. Always consult your own attorney, accountant or tax adviser as to the legal, financial or tax consequences and advice on any particular transaction." We have written about the numerous tax exceptions that may take place with all forms of life insurance.

Point 7 referring to "Adjust the policy as your needs change with flexible premium" - "This policy may lapse if premiums are not paid or if premiums are not sufficient to continue coverage." This is one of the biggest negatives of all Universal policies, flexibility can be a real issue.

Point 8 referring to"A variety of riders and benefits" - "Available at additional charge." This is not at all uncommon as some riders are free with some carriers and others charge for others as well.

Point 9 referring to" if you have other Farmers policies" - "A Multiple Policy Customer Rate Class may be available for customers with a new or existing Farmers policy."

[Editors Note: We have not included all of the disclosures, as numerous bullet points revolve around naming rights and are really not all that important, in our opinion. There are eight, although confusingly they begin at point 2.]

Farmers Insurance Pricing:

According to Effortless Insurance, in relation to Life Insurance: "Farmers is too expensive. Check out the table above..." He also notes: "Life insurance is a side gig for them, and they offer this to their current clients with the hope that, if they have auto and home insurance, they may get life insurance also." His research indicates that with regards to their term policies that the best competing 20 year $500,000 policy is about $34 per month (with Protective) vs $56 per month (with Farmers.)

We use the Term Life comparison as it is exceptionally difficult to compare Indexed Universal policies from two different carriers. These policies are not only different in yearly premium, but participation and cap rates, as well as very minute contractual differences.

What Famous People and Publications Have Said of Universal Life:

These quotes and articles related generally to Universal Life Insurance and not just the sub category of Indexed Universal Life Insurance.

Clark Howard: "I have long said anything that has the word ‘universal’ in it is radioactive."

Suze Orman on Universal Life: "I hate Universal Life." She stated this on air in response to a caller's question about Variable Universal Life.

Forbes Magazine, John E. Girouard Contributor: "The insurance industry has a dirty little secret that threatens the retirement plans of millions of unsuspecting families.The problem is buried in the fine print of universal life policies..."

The Wall Street Journal, Universal Life Insurance a 1980s Sensation has Backfired: "Universal life was a sensation when it premiered, and for some years it worked as advertised. It included both insurance and a savings account that earns income to help pay future costs and keep the premium the same.That was when interest rates were in the high single digits or above. Today, rates are completing a decade at historically low levels...The result is a flood of unexpectedly steep life-insurance bills that is fraying a vital safety net."

Whole Vs Term Life Insurance does not offer life insurance policies from Farmers New World Life.

Speak with an experienced advisor!

Speak with an experienced advisor!